Let's get straight to the big question: Is a lactation consultant covered by your insurance? For most families, the answer is a resounding yes. Thanks to the Affordable Care Act (ACA), most health insurance plans are required to cover breastfeeding support and counseling, often with no out-of-pocket costs to you.

Your Guide to Insurance for Lactation Support

Navigating insurance benefits can feel like trying to decipher a secret code, especially when you're busy with a new baby. You need answers about feeding your little one, and the last thing you want is a surprise bill for getting the help you deserve. The good news is that professional support is more accessible than you might think.

The key is understanding the difference between "in-network" and "out-of-network" providers. This one detail can completely change your experience, and how much you pay.

In-Network vs. Out-of-Network Explained

Think of your insurance plan as a membership to a club. In-network providers are the experts who have a direct contract with your club. When you see them, you get the best deal, which often means you pay nothing at all. Your insurance company handles the bill directly with them. Easy.

Out-of-network providers, on the other hand, don't have that special arrangement with your "club." You can absolutely still see them, but you'll likely have to pay them upfront. After your visit, you’ll ask your insurance company for a refund through a process called reimbursement. The catch? There's no guarantee you'll get the full amount back.

The challenge for many new parents is that the number of in-network lactation consultants hasn't kept up with the demand. This shortage often means your only option might be an out-of-network professional, making it crucial to understand how reimbursement works.

Why This Matters for Lactation Care

The difference between these two types of providers is a big deal when you're looking for support. Finding an in-network lactation consultant is the most straightforward path. You book a visit, get the help you need, and your insurance takes care of the bill with little to no paperwork on your end. It's as simple and stress-free as it gets.

But if you can only find an out-of-network consultant, you’ll need to become your own advocate. You'll pay for the service yourself and then submit a special receipt, called a superbill, to your insurance company. This guide will walk you through exactly how to do that.

To give you a clearer picture, here’s a quick breakdown of what you can generally expect from different types of insurance plans.

Quick Guide to Lactation Coverage Under Different Insurance Types

This table summarizes the typical coverage landscape for lactation consultants across major insurance categories, helping parents quickly identify what to expect.

| Insurance Type | Typical Coverage Level | Key Considerations |

|---|---|---|

| ACA Marketplace | Comprehensive. Often 100% covered with no cost-sharing. | These plans must cover breastfeeding support as a preventive service. In-network is usually free. |

| Private/Employer | Generally strong, but varies by plan. | Most are ACA-compliant, but "grandfathered" plans might have different rules. Always verify your benefits. |

| Medicaid | Varies by state. Coverage is expanding. | Many states now cover lactation services, but reimbursement rates and provider requirements differ. |

| TRICARE | Good. Covers up to 6 lactation counseling sessions. | Both in-network and out-of-network Certified Lactation Counselors (CLCs) or IBCLCs are typically covered. |

Remember, this is a general guide. The most important step is to always check the specific details of your own plan before booking a consultation.

Your Rights Under Federal Law

A major shift happened in 2010 with the passage of the Affordable Care Act (ACA). This law required most private health plans to cover preventive services for women without cost-sharing. This means no copays, coinsurance, or deductibles.

This mandate is the foundation of your coverage. Since 2012, non-grandfathered plans have been required to cover lactation consultations, ensuring this support is seen not as an extra, but as an essential part of postpartum healthcare. To better grasp the value they provide, you can learn more about what a lactation consultant does in our detailed guide.

Knowing your rights empowers you to confidently ask for the benefits you are entitled to receive.

Understanding Your Rights Under the Affordable Care Act

When it comes to getting insurance to cover your lactation consultant, the Affordable Care Act (ACA) is your biggest ally. But let’s be honest, the legal language can be dense and confusing. Let's break it down into plain English.

The ACA classifies lactation counseling as a preventive health service, putting it in the same category as a routine check-up or a flu shot. For most health insurance plans (especially those bought on the marketplace or provided by an employer after 2010), this means lactation support must be covered.

Better yet, it has to be covered without cost-sharing. This is a huge deal. It means you shouldn’t have to pay a copay, chip in for coinsurance, or hit your deductible before your insurance pays for this essential help. The law requires insurers to offer comprehensive support for the entire time you're breastfeeding. It's not a one-time perk, but a protected benefit for you and your baby.

The Grandfathered Plan Exception

Now, there's one major exception to be aware of: "grandfathered" plans. These are health plans that were created on or before March 23, 2010, and haven’t changed much since. Because they existed before the ACA became law, they don't have to offer the same preventive benefits.

How can you tell if you have one? Your insurance company is required to state it clearly in your plan documents. Look for a sentence like "This is a grandfathered plan" in your benefits summary. If you can't spot it, the fastest way to know for sure is to call the member services number on the back of your card and just ask. While they aren't very common anymore, they're still out there, so it's a critical first step to check.

The In-Network Provider Gap

Here’s where things get frustrating for a lot of parents. While the ACA mandates coverage, it doesn't always guarantee easy access. The law says insurers have to provide support, but it doesn't say how many in-network lactation consultants they need to have. The result? Many insurance companies have a tiny network of in-network IBCLCs, or sometimes, none at all.

This creates a maddening gap. Your plan says lactation help is covered, but you can't find anyone nearby who actually takes your insurance directly. This often forces parents to find an out-of-network provider, pay the full cost upfront, and then dive into the often-tricky process of getting reimbursed. It feels like a loophole that leaves families stuck between their legal rights and the reality of finding care.

A common issue undermining the ACA’s promise is the gap between policy and practice. This is something providers have struggled with, too. A 2013 national survey of IBCLCs found widespread confusion, with 41% unaware of their own insurance claim submission rates and 57% unclear on how insurance companies recognized their credentials. You can discover more insights about these challenges and how they impact care for new families on BioMed Central.

This confusion over provider credentials and the shortage of in-network options are exactly why so many families end up relying on superbills and paying out-of-pocket just to get the help they need. To learn more about how provider credentials play a role, you can check out our guide on whether insurance covers a Certified Lactation Counselor. Understanding this landscape is the first step in advocating for yourself to get the care you’re entitled to.

Navigating In-Network Versus Out-of-Network Consultants

This is where things can get a little tricky. Understanding the difference between an "in-network" and an "out-of-network" lactation consultant is absolutely key to getting your care covered. It’s a distinction that sounds small but makes a huge difference for your wallet and your stress levels.

Let's break it down. Think of an in-network provider like a preferred partner in your insurance plan’s exclusive club. Your insurance company has already shaken hands with them and agreed on a price. You show up, get the help you need, and your insurance settles the bill directly. For many parents, this means you pay nothing at all.

An out-of-network provider, on the other hand, is a specialist who isn’t part of that club. They are just as qualified, often more so, but your insurance doesn't have a pre-arranged deal with them. This usually means you’ll have to pay for the visit yourself and then submit a claim to your insurance company for reimbursement. It’s a bit like mailing in a rebate form and crossing your fingers for a full refund.

The Challenge of Finding an In-Network IBCLC

In a perfect world, you’d just find an in-network lactation consultant and call it a day. The reality? For many new parents, it feels like searching for a needle in a haystack. There simply aren't enough International Board Certified Lactation Consultants (IBCLCs) who are credentialed directly with insurance companies to meet the overwhelming demand.

This shortage creates a huge bottleneck. Even though the Affordable Care Act (ACA) mandates that your lactation support should be covered, if your insurer doesn’t have enough in-network providers, you're left holding the bag. You either go without the expert help you need or you find a great out-of-network provider and brace yourself for the reimbursement dance.

Taking a moment for some extra reading on understanding in-network vs out-of-network care can really pay off, giving you a clearer picture of how to manage your healthcare finances.

Why Is the Network So Small?

So, why is it so hard to find an IBCLC in your network? It’s a systemic problem, and one the industry is slowly trying to fix. Here are a few big reasons:

- Credentialing Hurdles: The process for an IBCLC to become an in-network provider is often a bureaucratic nightmare. It involves mountains of paperwork and administrative hoops that are incredibly difficult for a small, independent practice to jump through.

- Low Reimbursement Rates: Frankly, some insurance companies just don't pay very well for lactation services. The low rates can make it financially impossible for many highly-skilled consultants to afford joining a network.

- Lack of Recognition: For too long, the broader healthcare system failed to see IBCLCs as the essential medical providers they are. This has seriously slowed down their integration into insurance networks.

This gap between what the law requires and what’s actually available leaves many families feeling frustrated and stuck. For instance, our guide on finding lactation consultants covered by Blue Cross Blue Shield dives into some of the plan-specific headaches you might run into.

Here's the bottom line: Just because your insurance plan says it covers lactation services doesn't mean they've made it easy for you to actually get them. You often have to become a fierce advocate for your own care.

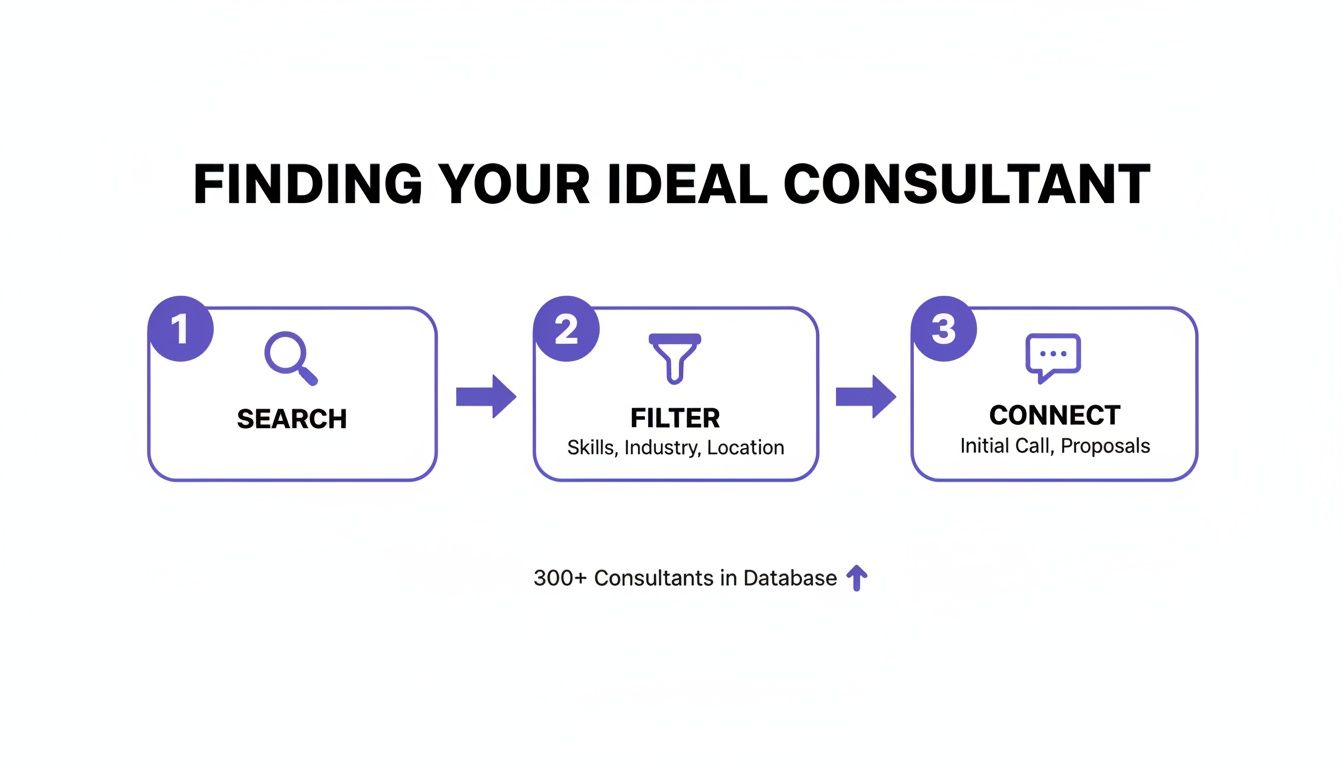

Modern Tools Can Simplify Your Search

The good news is you don’t have to go it alone. The old way of doing things, like cold-calling a long list of providers or wasting hours on hold with your insurance company, is becoming a thing of the past. Today, modern platforms are stepping in to make the whole process much easier.

A marketplace like Bornbir, for example, is designed to cut through the confusion. It lets you filter your search for lactation consultants based on your specific insurance plan. This one simple step can save you countless hours of frustration by connecting you directly with providers who are either in-network or are pros at helping families get reimbursed.

Instead of starting from square one, you can begin with a curated list of consultants who are already a great fit for your insurance plan. This frees you up to focus on what really matters: finding the right person to support you and your baby on your feeding journey, without getting bogged down in administrative headaches.

How to Verify Your Lactation Benefits Step by Step

Let's be honest, calling your insurance company can feel like a huge chore, especially when you're tired and overwhelmed. But going in with a clear strategy can turn a potentially frustrating task into a quick, productive one. Having a script and knowing exactly what to ask can get you all the answers you need in a single phone call.

The goal here is simple. You want a clear "yes" or "no" on coverage and a full understanding of what you need to do to avoid any surprise bills down the road. You’re not just asking if a "lactation consultant covered by insurance" is a thing; you're digging into the specific rules of your plan.

Preparing for the Call

Before you dial that number on the back of your insurance card, take just a minute to gather a few things. This little bit of prep work will make the conversation go so much smoother.

- Your insurance card (so you have your member ID number handy)

- A pen and paper to take detailed notes (don't skip this!)

- The full name and provider number of the lactation consultant you want to see, if you already have someone in mind

When you get an agent on the phone, make it a habit to jot down their name and a call reference number. This information is gold if you need to call back or follow up on a claim later.

Key Questions to Ask Your Insurance Representative

This is the most important part: knowing what to ask. Insurance agents handle tons of calls, so being direct and specific with your questions gets you the best results. Think of it as a checklist to make sure nothing gets missed.

Before you dive in, here’s a quick guide with the essential questions you'll want to ask your insurance company representative. Getting clarity on these points upfront can save you a world of headaches and unexpected costs later.

| Question Category | Specific Question to Ask | Why It's Important |

|---|---|---|

| Coverage Basics | "What is my coverage for preventive lactation counseling with an International Board Certified Lactation Consultant (IBCLC)?" | Confirms if your plan covers IBCLCs specifically, which is the gold standard for lactation support. |

| Referrals & Pre-Approval | "Do I need a referral from my pediatrician or OB-GYN to see an IBCLC?" | Some plans require a doctor's referral to cover the visit, so you need to know if this extra step is necessary. |

| Visit Limits | "How many visits are covered? Are there limits per year or per baby?" | This helps you understand the scope of your benefit and plan for any additional visits you might need. |

| Virtual Care | "Does my plan cover telehealth or virtual lactation consultations?" | Telehealth is incredibly convenient, but not all plans cover it. It's crucial to confirm this if you're considering virtual support. |

| Authorization | "Do I need to get prior authorization before my visit?" | Getting pre-approval might be required to ensure the service is paid for. Skipping this step could lead to a denied claim. |

| Provider Network | "Does my plan have any in-network IBCLCs within a 30-mile radius of my home?" | This question helps you find a provider that will cost you the least out-of-pocket. |

| Out-of-Network Rules | "If there are no in-network providers available, how does my plan cover out-of-network IBCLC care?" | If you can't find an in-network provider, this tells you what your options are for getting reimbursed for someone out-of-network. |

| Reimbursement Process | "What is the process for submitting a claim for reimbursement with a superbill?" | This clarifies the exact steps and paperwork you'll need to get your money back for an out-of-network visit. |

Asking these targeted questions ensures you have a complete picture of your benefits. Don't be shy about asking the representative to repeat information or explain terms you don't understand. It's their job to help you.

Understanding Insurance Jargon

During the call, you might hear a few key terms that can sound confusing. Knowing what they mean ahead of time keeps you in control of the conversation.

- Prior Authorization: Think of this as getting a permission slip from your insurance company before your visit happens. They need to approve the service in advance for it to be covered.

- Deductible: This is the amount of money you have to pay out-of-pocket for healthcare services before your insurance plan starts to pay. The good news? For ACA-compliant plans, preventive lactation care should be covered 100% even before you meet your deductible.

- Superbill: This is just a fancy name for a detailed invoice from your out-of-network provider. You'll send this document to your insurance company to get paid back for the visit.

Finding the right support doesn't have to be a scavenger hunt. This is where a modern platform can really help you find, filter, and connect with a lactation consultant who fits your exact needs.

Using a focused search-and-filter approach can simplify the whole process, letting you bypass endless phone calls and internet searches. For more tips, check out our guide on how to find a lactation consultant.

These verification steps are more critical than ever, given the global shortage of lactation consultants. The entire workforce is expected to be just 38,154 by March 2025, with the United States having the largest share at 19,000. This imbalance makes it tough for many insurance companies to build adequate in-network options, which puts more of the responsibility back on parents to confirm their benefits and find qualified care.

Getting Reimbursed for Out-of-Network Care

So, you can't find an in-network lactation consultant and feel like paying out-of-pocket is your only option. Don't worry. It's not the end of the road. Getting reimbursed for out-of-network care is absolutely possible, and this section is your playbook for turning that intimidating process into a few simple steps.

Your golden ticket for getting that money back is a document called a superbill. Think of it as a detailed, itemized receipt designed specifically for your insurance company. It’s way more than a simple invoice; it has all the special codes and information your insurer needs to process your claim.

Cracking the Code of the Superbill

After your visit, your IBCLC will give you this crucial document. It might look a little technical, but its job is simple: to prove you received a medically necessary service.

A proper superbill always needs a few key pieces of information. If anything is missing, your claim could get delayed or even denied, so it’s worth a quick double-check before you send it in.

Your superbill must contain:

- Your Information: This includes your full name, date of birth, and address.

- Your Baby's Information: It also needs your baby's full name and date of birth.

- Provider’s Details: The IBCLC’s name, credentials (like their NPI number), and contact info are essential.

- Diagnosis Codes (ICD-10): These codes tell the insurer why you needed help, for instance, for a painful latch (P92.5) or low milk supply (P92.2).

- Procedure Codes (CPT): These codes explain what services you received, like preventive counseling (99401-99404).

Your lactation consultant will handle filling this out correctly. Your job is just to make sure you get it and that it looks complete before sending it off. For more information on using pre-tax funds for these expenses, you can check out our guide on how lactation consultants are eligible for FSA and HSA reimbursement.

Submitting Your Claim for Reimbursement

Once you have your superbill, you’re ready to file the claim. Most insurance companies have an online portal where you can upload the document directly, which is usually the fastest way to get it done. You can also typically find a claim form on their website to print and mail in.

To give your claim the best chance of success, think about including a letter of medical necessity. This is a short letter from your pediatrician or OB-GYN explaining that lactation support was essential for your or your baby’s health. It really adds weight to your claim.

A letter of medical necessity acts as a formal recommendation from a trusted medical authority. It signals to the insurance company that this wasn't just a "nice-to-have" service but a critical component of postpartum care.

Navigating Claim Denials and Appeals

Now for the part no one wants to deal with: sometimes, claims get denied. It’s frustrating, but a denial isn’t a final “no.” It's often just the start of a conversation.

First, find out exactly why the claim was rejected. Call your insurance company and ask for the specific denial reason in writing. Common culprits are simple administrative errors like a typo in your member ID, a missing code, or the insurer incorrectly stating the service isn't covered.

If the denial seems wrong, you have the right to file an internal appeal. This is a formal process where you ask the insurance company to take a second look. Your appeal should be a clear, concise letter that includes:

- A copy of your original superbill.

- The letter of medical necessity from your doctor.

- A brief explanation of why you believe the service should be covered under the ACA’s preventive care mandate.

Persistence is your best tool here. The appeals process can feel slow, but many parents who follow through are eventually successful. Make sure to keep a record of every phone call and every document you send. This organized approach shows you’re serious and helps you stay on top of the process until you get the reimbursement you deserve.

Common Questions About Insurance for Lactation Care

Even after you've got the basics down, you're bound to have more questions. It's totally normal to feel a little lost when you're trying to figure out insurance. This section is designed to give you quick, clear answers to the most common hurdles parents run into.

Think of this as your go-to FAQ for those tricky gray areas that the main guide doesn't cover. Let’s clear up the confusion so you can get the support you need.

What Happens If My Insurance Plan Is Grandfathered?

You might hear the term "grandfathered" thrown around and wonder what it means for your coverage. A grandfathered plan is simply a health plan that was created on or before March 23, 2010, and hasn't changed its core benefits in any significant way since then.

Because these plans existed before the Affordable Care Act (ACA), they're exempt from many of its rules. This means they aren't required to offer preventive benefits like lactation support without cost-sharing. If your plan is grandfathered, you might be on the hook for a copay, have to meet your deductible, or even pay the full cost out of pocket.

So, how do you know if you have one? Your insurance company is required to state this in your plan documents. The easiest way to find out for sure is to just call and ask. Even if it is a grandfathered plan, it never hurts to see what lactation benefits they do offer. Some still provide partial coverage.

Does Insurance Cover Virtual Lactation Consultations?

For new parents, telehealth has been a game-changer. The good news is that most insurance plans have caught up and now cover virtual lactation visits, but it’s not a universal guarantee.

Most major insurance companies treat telehealth appointments the same way they do in-person visits, especially since the pandemic pushed virtual care into the mainstream. Still, you absolutely need to verify this with your specific plan to avoid any surprises.

When you call your insurance provider, be direct. Ask, “Are telehealth lactation consultations with an IBCLC covered under my plan?” Getting a clear "yes" upfront can save you from an unexpected bill later.

What Billing Codes Does My Lactation Consultant Use?

You definitely don't need to become a medical billing expert, but knowing a few key terms can make you feel more in control. Lactation consultants use specific codes on their claim forms to tell the insurance company what services they provided.

These are called CPT (Current Procedural Terminology) codes. Your IBCLC will handle all of this, but just so you know what you might see on a superbill, here are a few common ones:

- 99401-99404 for preventive medicine counseling sessions.

- S9443 for a lactation class.

Your consultant knows which codes work best and are most likely to be accepted. Your job is to focus on feeding your baby, not memorizing billing jargon.

My Insurance Denied My Claim. What Do I Do Now?

First, take a deep breath. Getting a denial letter feels like a final "no," but it’s often just the start of a conversation. An initial denial is far from the end of the road.

The most important thing to remember is that you have the right to appeal. Persistence is your greatest tool when a claim is denied. Many parents successfully overturn denials by following the process and advocating for their care.

Start by calling your insurance company and asking for the exact reason for the denial in writing. More often than not, the problem is a simple administrative slip-up, like a typo in a code or a missing piece of paperwork. Your IBCLC can usually fix this quickly and resubmit the claim.

If it's a more complex issue, you have the right to file an internal appeal. This involves writing a formal letter that explains why the service should be covered, leaning heavily on the ACA mandate. You'll want to submit this letter along with your original superbill and a letter of medical necessity from your doctor. New parents face immense challenges beyond just the financial side of things. To learn more about how a lack of rest can affect you, consider reading about the significant impacts of sleep deprivation on health. Pushing through the appeals process can feel draining, but it very often leads to a successful reimbursement.

Finding the right support shouldn't add to your stress. With Bornbir, you can easily search for lactation consultants, doulas, and other perinatal professionals who are familiar with the insurance landscape. The platform allows you to filter providers and connect with the right expert for your family, saving you time and giving you peace of mind. Find your perfect match at https://www.bornbir.com.